2 Scary AF Stock Charts😱📈

With stocks at record highs, only a bright future or more inflation could help this rally continue — essentially a very rosy scenario; but this recent rally could turn on a dime. With the uncertainty in the upcoming elections plus rising geopolitical risks (which I discussed recently in this TV interview—my segment is a little over 17 minutes into the clip Business Matters Full Broadcast (Oct. 11) | NTD), It would make sense to focus more on Risk Management.

All eyes are on the Fed plus earnings—or 🤔 should I say, EARNINGS GROWTH?

Yes! It will take a continuation (if not an acceleration) of Earnings Growth to keep the party going… The problem is, in a “party” of 1500—only 7 seem to be having a good time… 🤔😳👎🏼

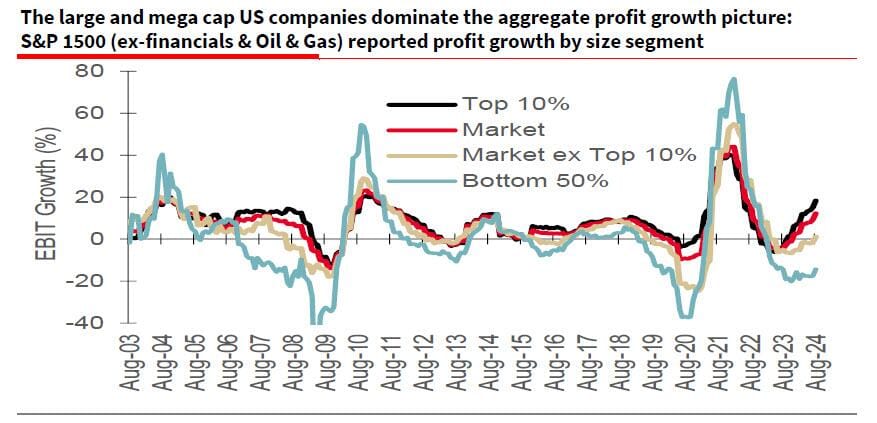

The following chart from a recent note from SocGen's Albert Edwards shows what I mean. As you can see, half of the companies in the S&P 1500 are having trouble growing earnings…

So who’s pulling the weight? I’ll give you seven guesses…😐 #Mag7

Bank of America Research produced the following chart showing that 493 of the 500 stocks in the S&P500 are expected to experience a slowdown in earnings growth.

So we know that we have only 7 All-Stars, and they have 493 hanging from their coattails. 🤔

Then what happens when the All-Stars get tired or worn out from pulling all the weight? Hint, hint… #Recession

I know what you might be thinking…”How could we be heading for a recession with GDP strong plus the resilient labor market?” Well, let me pull apart that argument using three bullets:

- GDP measures “spending” more than “production”— HUGE difference in terms of how healthy they are for the economy; not all spending is productive.

- Government spending is increasing around the world, which is NOT healthy for the economy; and the debt is piling up at an accelerating and scary rate. Here’s a recent article from Bloomberg discussing the $100 TRILLION problem: https://www.bloomberg.com/news/articles/2024-10-19/the-world-s-100-trillion-fiscal-timebomb-keeps-ticking

- With the election coming up, inflation still above targets, AND wages increasing, I would bet money (and have) that we will see SIGNIFICANT DOWNWARD REVISIONS on the recent jobs numbers. It seems, from recent policy, trends, and the lack of pro-American rhetoric, that Biden’s administration is learning tricks from China 🇨🇳 and the communists. Said differently, there’s no way that the “official” labor statistics are being manipulated as we approach the election. That’s why I pay more attention to the data from payrolls and tax receipts.

The bottom line is that ANY further slowdowns in the earnings growth of the Mag7 have significant ramifications for the stock market and the ONLY cure in the Fed’s playbook is more monetary easing (read: InflationAF). 🤔🤨