More Things I Love About BuzzFeed Stock + Warrants: Part 2: #Technicals 🤑🤑🤑

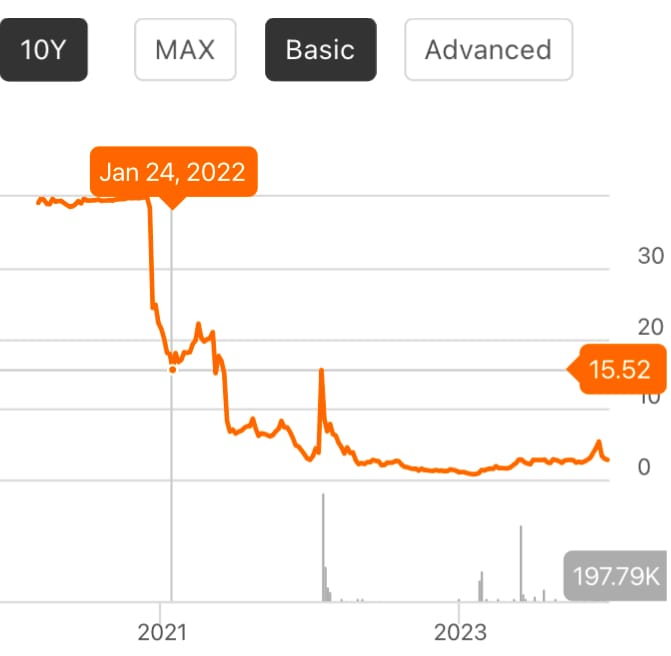

Once upon a time, BuzzFeed was a great example of a media company with the capability to utilize AI in a better way. But to most investors today, BuzzFeed is just a SPAC that got spanked! You may notice the Niagara-like fall in the stock price shown in the chart below.😳 (Btw, SPAC stands for ‘special purpose acquisition vehicle.” 🤓)

But that’s not what this article is about—this article is about why I expect this stock price to double sooner than later. If you haven’t read Part 1, I strongly suggest you do so you can follow my train of thought; in part one, I discuss the fundamentals of the business. But first, what business are they in???

Infamously, BuzzFeed is mainly remembered for being first to publish the #RussiaHoax (for more on this topic, I highly recommend Kash Patel’s ‘Government Gangsters’). Needless to say, that didn’t help their credibility…The company lost tons of money and the stock price dived. 👇🏼😱

The business needed to be “turned around”…🤔 They needed to focus on sales more, and spending less. They needed to sell some assets and pay down debts.

Ladies and gentlemen, they have done so…I believe that the turnaround is true, and that the equity is attractive AF... 🤨😬😇

That said, and once again, this not to be construed as investment advice—this is simply a productive (and perhaps potentially profitable) thought experiment for the curious capitalist.

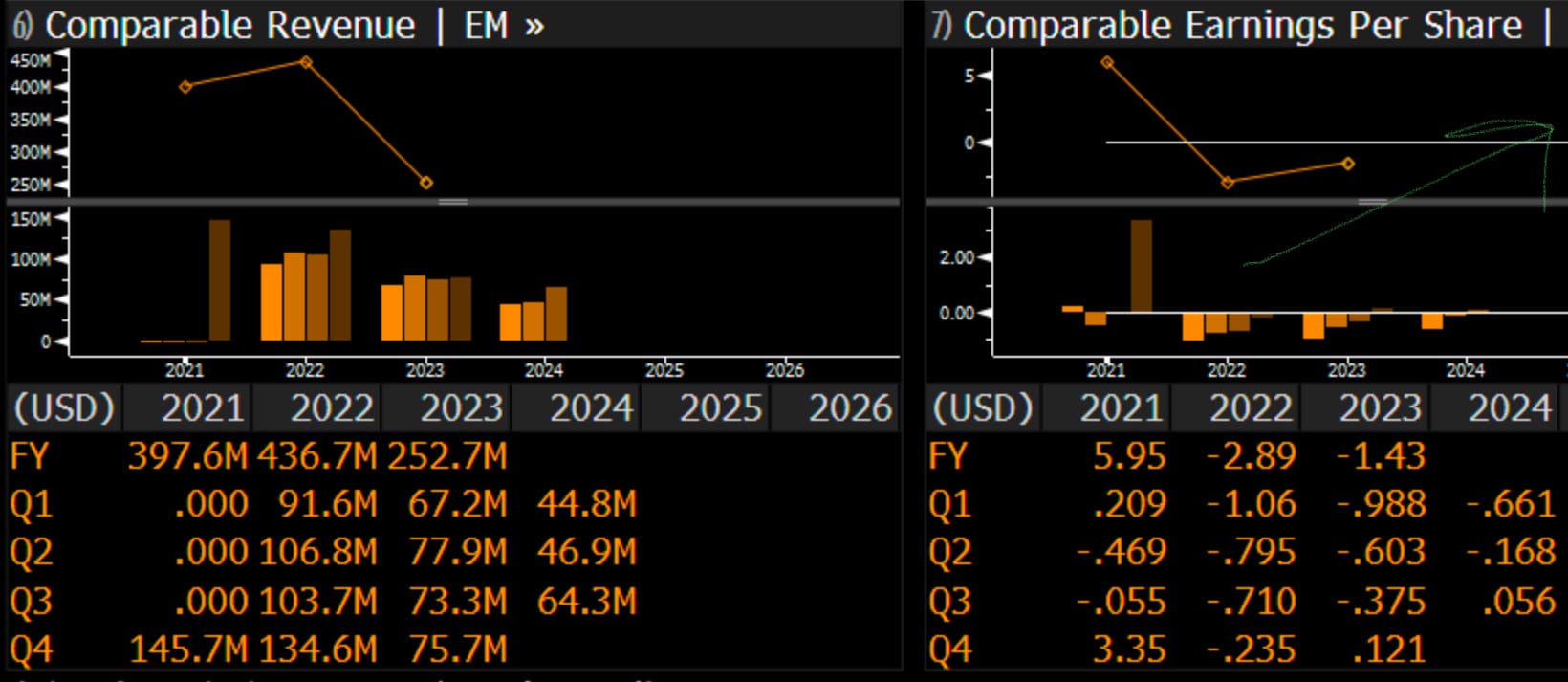

The data above is more than telling…Revenues showed solid growth in 2022 (TOP LEFT). But how much of that revenue made it to the “bottom line”? 🤔

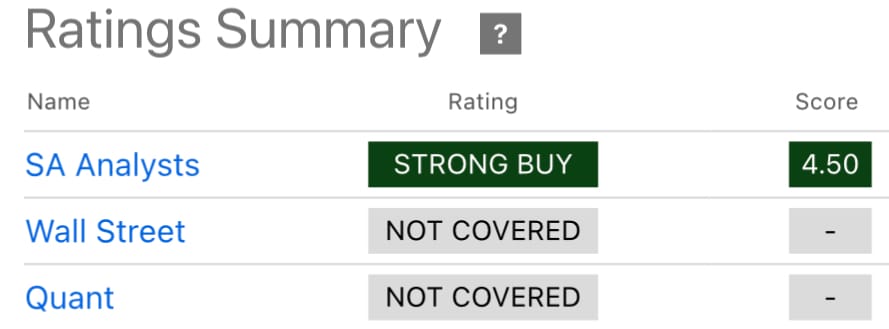

Nada…🤨 The data above shows losses in ALL of 2022 and almost all of 2023. Unsurprisingly, Wall St lost interest…👇🏼

But, although Wall St may have stopped caring 👆 others have not…It seems authors and analysts on Seeking Alpha have started to take notice—and they—like us—seem to like what they see. 😍

Looks like we have institutional bids recently; this is apparent when you look at the volume bars in the above chart and notice the recent trend...

It looks to me like most of the above average volume was bidding up the share price—it was bullish…But the recent decline in the stock price has been on much lower volume. The bulls seem to outnumber the bears. And when the company announces results for 4Q24, I think the number of Wall St analysts will surely increase—but so too will the stock price.

We identify as bulls and we remain bullish on #BuzzFeed (BZFD) stock plus the warrants (BZFDW). In Part 3 of this series, I will review the sentiment on Wall Street and the structural factors that make BuzzFeed equity so attractive.

***NOT TO BE INTERPRETED AS INVESTMENT ADVICE***

Full Disclosure: LONG: $BZFD, $BZFDW, + Call Options 🤑