Epoch Times: Real Estate Economists Predict High Mortgage Rates, but More Affordable Homes in 2024

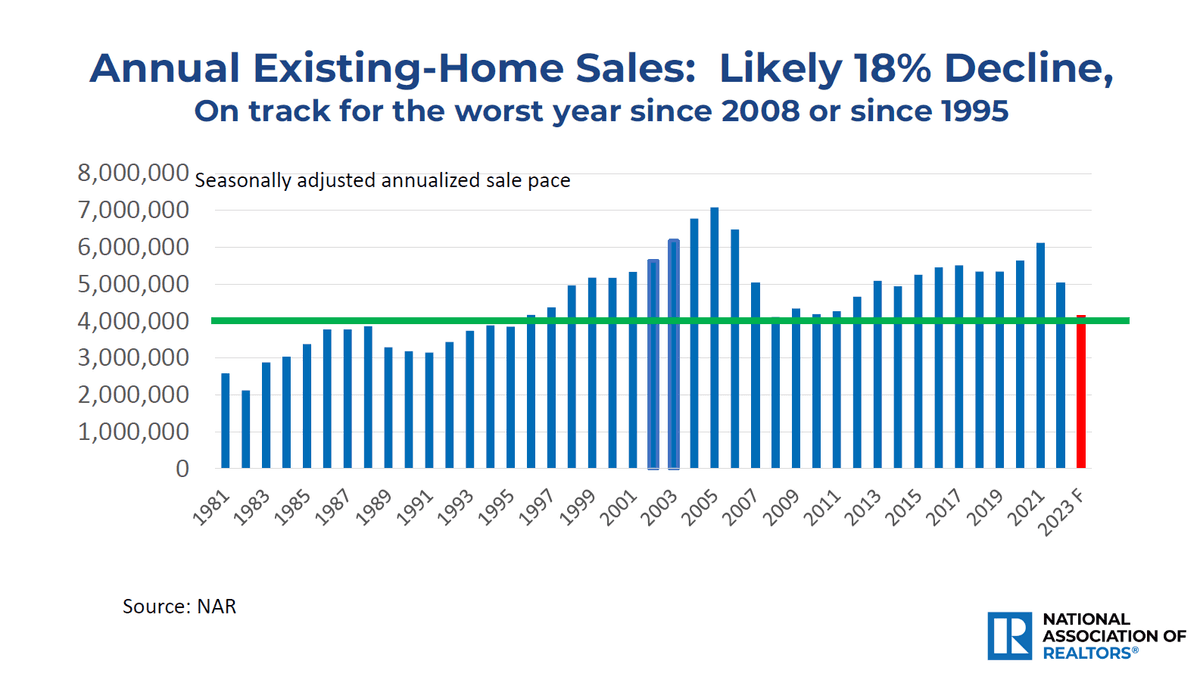

This year could wind up being the worst year since 2008 or 1995, according to the National Association of Realtors.

On the heels of the Federal Reserve’s decision to keep interest rates the same for now, real estate experts from the National Association of Realtors (NAR) and Realtor.com are predicting mortgage interest rates will stabilize around 6.5 percent by mid-2024.

In addition, they’re forecasting more affordable housing options by next spring and naming Austin, Texas, as the top real estate market to watch in 2024. Other Texas markets with pent-up demand include Dallas-Fort Worth and Houston, as well as Nashville, Tennessee, and Dayton, Ohio. On the East Coast, Durham and Chapel Hill, North Carolina; Portland, Maine; and Harrisburg, Pennsylvania, were also listed as “top markets” in 2024.

Speaking at a virtual real estate summit this week, both NAR and Realtor.com professionals remain optimistic that the static interest rates will spur more potential home sellers who are now on the fence about listing their properties. However, as for this year, Lawrence Yun, NAR’s chief economist, noted that 2023 experienced an 18 percent decline in home sales.

“This could end up being the worst year since 2008 or since 1995,” he said. “The Fed may begin to consider cutting rates in 2024, and while it’s a presidential election year, that should not affect their decision.”

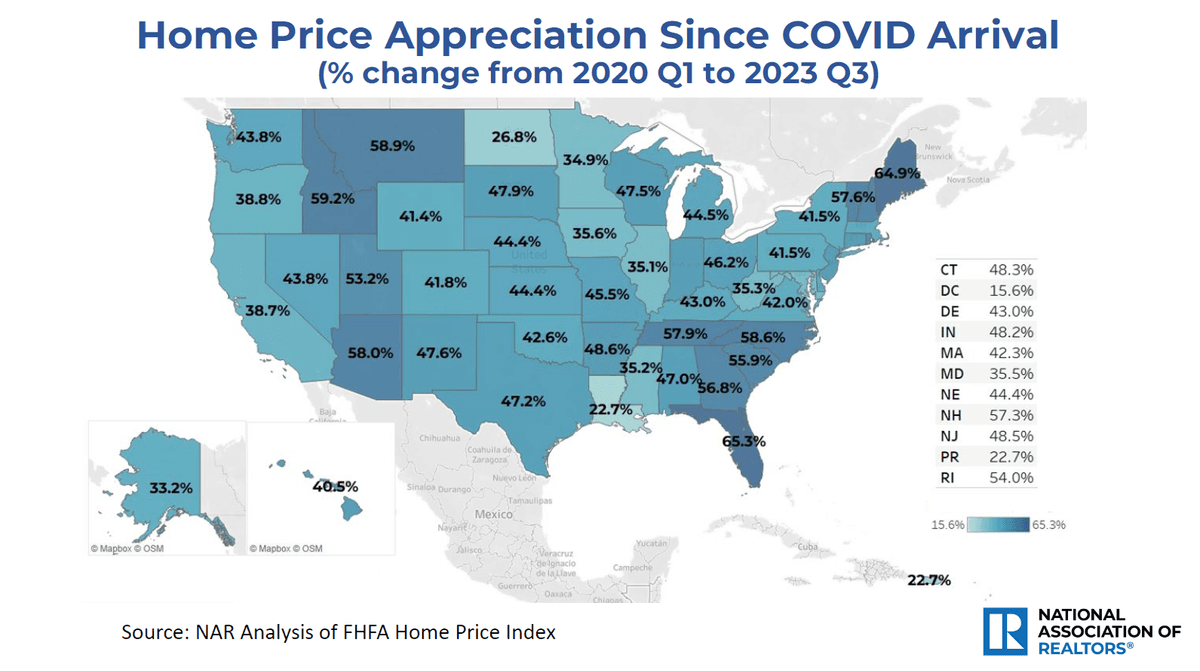

Since 2002, home prices have increased in every state, with Maine leading the pack at 64.9 percent, Idaho second at 59.2 percent, and North Carolina third at 58.6 percent. While the lack of inventory still plagues the market, Mr. Yun noted that sales of new construction are on track to be one of the best years since 2008.

“Compared to 2017, inventory conditions for builders have doubled, but the total needed is still under average,” he said.

In the meantime, rents across the United States are rising by about 6.8 percent, with the highest demands recorded in Austin, Texas, and Charlotte, North Carolina. Speaking at the virtual summit, Danielle Hale, chief economist for Realtor.com, echoed Mr. Yun’s forecast of interest rates in the low 6 percent range by the end of 2024.

“I think we are taking steps in the right direction, and as mortgage rates begin to turn the corner, we’re hoping for rates around 6 to 6.5 percent,” she added.

Realtor.com suggests the Midwest and South will continue to offer the most in terms of housing affordability. “People who can work remotely will continue to relocate from higher-cost areas like the Northeast and California,” she said.

However, both Mr. Yun and Ms. Hale agree that first-time potential homebuyers are not without challenges. NAR revealed a new survey showing 61 percent of these buyers say locating the right property is their biggest obstacle. More than 38 percent named saving for a down payment and understanding the process as additional challenges. Only 17 percent said they feared difficulties in obtaining a mortgage.

For those who are able to save enough for the down payment, 22 percent indicated they could stretch financially for only 1 to 5 percent, while 26 percent said they could afford the standard 20 percent.

“Other first-time would-be homeowners may decide to continue renting until they find something more in their price range,” Ms. Hale said. “It’s unfortunate that younger generations can feel locked out of the housing market.”

Vijay Marolia, managing partner and chief investment officer of Regal Point Capital in Orlando, Florida, recommends first-time homebuyers consider multi-family properties that will create a continuous source of income.

“The reality is that it’s never been harder to afford a home now,” he told The Epoch Times. “Even if you do everything you’re supposed to do, get a good education, a good job, and save your money.” Instead, Mr. Marolia recommends researching areas that are up-and-coming and offer more affordable housing options. “For example, Florida, the Carolinas, and Texas are still growing and may offer a lot of potential.”

Mr. Marolia also indicated that many locations offer special programs for first-time homebuyers seeking multi-family dwellings. Potential homeowners could qualify for lower-interest loans, downpayment assistance, or even personal loans from parents or relatives. “For someone who is willing to strategically plan for the future, this is a great way to get started,” he explained. “You’ll have a roof over your head and rental income, and that’s how you begin to create your wealth.”

For those new to being landlords, Mr. Maroila recommends seeking out someone who has been a property manager and asking questions. “Also, if you can find someone who has been a multi-family unit manager, that’s how you can get access to some of the best deals out there.”

Mr. Maroila believes home ownership is attainable for everyone, but they have to be willing to do some homework. “Everyone’s bills are different,” he said. “Some people have children, and while others don’t, maybe they eat at restaurants a lot. The first thing to do is look at your last three months of bank statements and see where you’re spending your money. Then figure out where you can save, as well as your paying point.”