An Inconvenient Truth About Inflation Targeting; The Food Chain of Money: Part I

Today there is NO NEED, indeed no good reason to target inflation at 2%.

Our bills are growing at the fastest rate in about 40 years...That we are experiencing inflation may not be news to you, but are you aware of why? Why is inflation a policy? And did you know that inflation effects different people in different ways? Who really benefits, and how?

In this post I want to explane the origins of inflation targeting as well as the dangerous path we're currently on. I also want to make a dangerous prediction--I think the Federal Reserve may have no choice to but to RAISE the target INFLATION RATE to 3%. This is a terrible idea, which I hope to explain below; but let's take a step back...

Why is it a good idea to make our lives more expensive every year forever, and on purpose?

And if it is, why is 2% ideal...I mean, if 2% is good, wouldn't 3% be better? If less is more, than why don't we aim at 1%? What's so great about 2%???

STATUS QUO

The Federal Reserve (along with central banks around the world) targets inflation at 2% per annum. Said differently, we the people have been made to believe it's "natural" and "good" for our EXPENSES to DOUBLE EVERY 36 YEARS. At 3%, our bills would double in 24 years. And at our current reported rate of 6%, the doubling happens in a dozen years. Without a comensurate doubling of income or assets, what happens is hardship...

We have consistently been told inflation is to our benefit but, we have never been told why?

"The American people have no idea they are paying the bill. They know that someone is stealing, but they think it is the greedy businessman who raises prices or the selfish laborer who demands higher wages or the unworthy farmer who bids up our prices. They do not realize that these groups also are victimized by a monetary system which is constantly being eroded in value by and through the Federal Reserve System."

~ G. Edward Griffin, The Creature from Jekyll Island

(A Second Look at the Federal Reserve)

So, then why even have a target inflation rate? 🤨 Or, why not just set it at zero? 🤔

That way, tomorrow's bills would theoretically be the same as yesterday's, and people on a fixed income wouldn't suffer needlessly. Moreover, people regardless of income, wouldn't have their savings evaporate. Without inflation, we would have more to buy with our money. Our purchasing power would be stronger. The quality of our lives would be greater.

But here's an even better question; why not set a target rate BELOW ZERO?

IS DEFLATION REALLY THAT DANGEROUS?

Why not target deflation instead? This would decrease the cost of living over time thus, guaranteeing systematic and widespread increases in quality of life; not just for the 1%, but for 100%...

And by the way, isn't deflation more "natural" than inflation absent the Gold Standard? Think about it; the more time one spends in their career, the better they usually get. They learn new skills. They perform old skills faster. The quality and quantity of the utility they produce increases over time naturally. With stable prices, quality of life would continue its natural progession upward.

But prices are NOT stable; they fluctuate in the short term but always seem to go higher over the long term; this is the result of inflation targeting.

The Federal Reserve aims to grow prices by 2% per year; every year, no matter what. Why?

It's certainly not because we all get 2% annual raises - most people do not. Many will get fired. It's certainly not because we grow smarter by 2% per year, or more talented or beautiful (wouldn't that be nice). For many people, unfortunately, the exact opposite is true.

Why then create a problem unnecessarily? Especially considering that those most negatively effected by it are EXACTLY the people who can least afford it. Although it's common knowledge that lower income families are most hurt, today, inflation is effecting even those higher on the money food chain; as Bloomberg reports: Inflation Is Even Pinching the Middle Class Now

The answer to why we have a 2% inflation target, at least the ORIGINAL REASON, for its existence lies with GOLD. Allow me to explain...

BACKGROUND

For thousands of years, humanity has relied on precious metals, gems, and stones as money. Most of our reliance has been on gold. Gold was and is valued for many reasons (enough to fill another blog post) but one of the MOST IMPORTANT has to do with the LIMITED SUPPLY. Gold is rare. Dollars are not–not anymore...

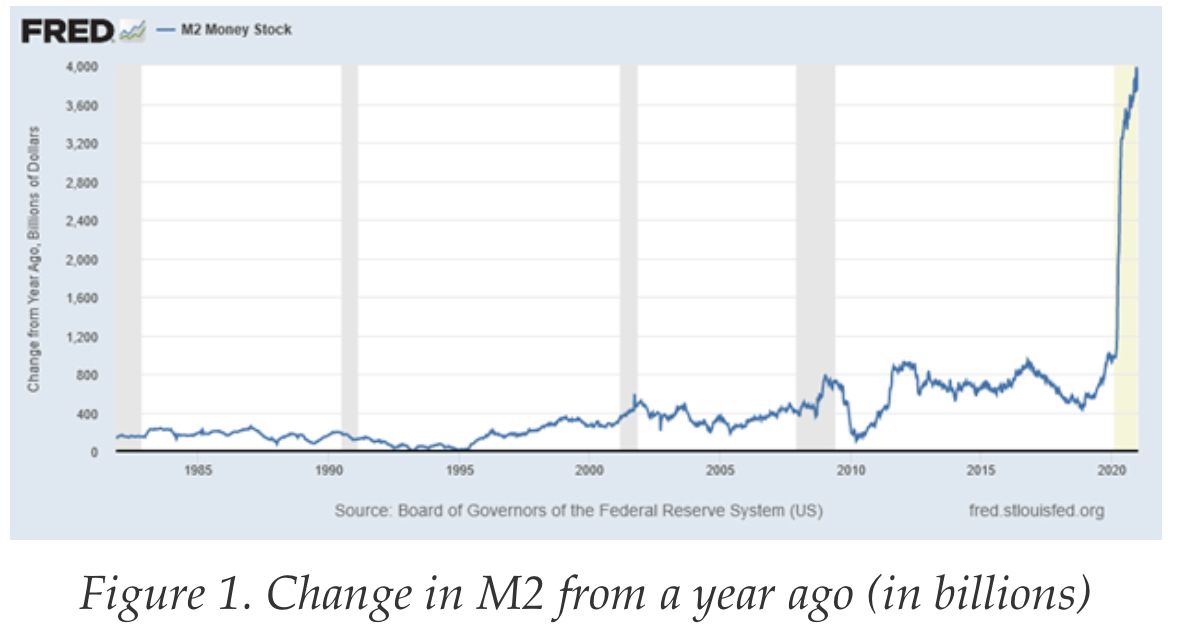

For centuries if not longer, the natural growth in the global supply of gold grew at rates between 1% - 3% annually. In order to grow this supply we had to search for it slowly; we had to dig for it. Creating money took time, and it took skill. Today it only takes a "crisis" and the push of a button.

A little over 50 years ago, our country began potentially the most dangerous, and arguably the most economically destructive globally coordinated policy in the history of mankind. They removed (albeit, while being told it was temporary) the ONLY protection our currency had against political, professional, or personal abuses over the long term; our GOLD STANDARD - a phrase still used globally in terms of geography as well as univerally, across industries and culture. The gold standard was there to protect us. It no longer does. Today there is NO NEED, indeed no good reason to target inflation at 2%.

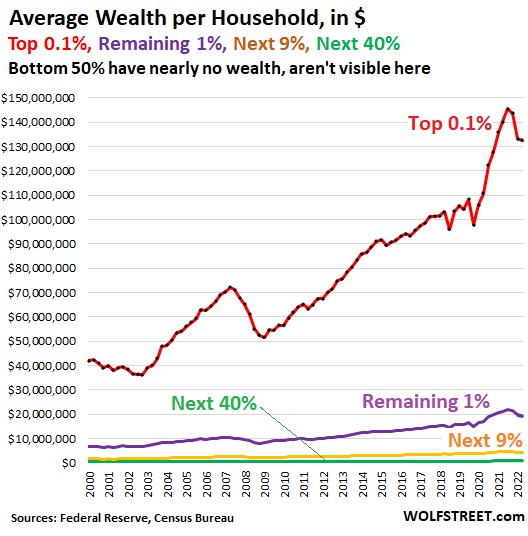

A "temporary" policy has permanently altered the way people live. The middle class has evaporated as those with assets grow wealthier and those without assets struggle to keep up with everincreasing bills. Meanwhile, the situation continues to worsen as more and more newly printed money drives up the price of everything. Without limits, controls, or realistic boundaries, we only welcome danger...

As if the ridiculous growth in our money supply above wasn't scary enough, let's not forget that this chart was issued BEFORE WE DOUBLED OUR DOLLARS AGAIN! As the world was watching out for the coughs that spread Covid-19, our central bank was coughing up more money than ever before. We created more money faster than we could spend it; and we damn sure started spending it...

Bubbles were blown, bottlenecks developed, and weird things that we've never seen started happening...For example, used car prices went UP! Folks, this hasn't happened before because in a healthy economy and free markets, it SHOULD NOT EVER HAPPEN! The Fed really fu$%ed things up for a lot of people...Worse still, it shouldn't have been a surprise to ANYONE, much less the PhDs in charge. Remember INFLATION isn't complicated or confusing, which I discussed here.

Today, the face masks are gone, and world is returing to "normal" but even now, the Federal Reserve's balance sheet is still DOUBLE the size shown in the chart above. Still...No wonder people are buying Bitcoin (which has a limited supply).

But is inflation really a problem for everyone? Asked differently, are there people that can actually benefit from this? The short answer is YES; the long answer is below:

THE FOOD CHAIN OF MONEY

In the world of money, there exists a food chain, and it is not unlike the one that feeds us. Not only will some eat first; but, some will eat others.

In our current system, those in, or closest to the banks and government contractors are going to eat first; their money will come to them before it depreciates to the point where it reaches the masses. When it finally does, it will not buy as much before. By the time newly created money is in the possession of the people, its purchasing power will have decreased. Meanwhile, those that own assets, will see higher figures in their annual statements as more of the new money continues chasing the same old goods and services; hence, more INFLATION.

The big eat the small while the small eat the smaller. This has been the story of not just humanity, but all of the animal kingdom. And perhaps it's more than just a story - perhaps it's more akin to a law. Not one legislated by "we the people," but one ruled by Mother Nature.

Why then are we protecting a policy of poverty? I'll get to that in Part 2...

TO BE CONTINUED...