What the Market is Missing on BuzzFeed Part 3: Sentiment & Structure

Because Wall Street is made up of humans (plus the algorithms they create), Wall Street, or “the market” can be said to have “feelings”. Wall St calls its feelings SENTIMENT. When sentiment sucks, stocks can sink…In this post, I will discuss how extreme fluctuations in Wall Street’s sentiment towards BuzzFeed has potentially created an opportunity to acquire shares (and warrants) at a drastic discount. I believe this discount is so drastic, that a potential doubling in the share price is more than realistic over the next 6-18 months.

This the third in my series of articles explaining why BuzzFeed equity seems undervalued. Those that have been following the series already know that we are very bullish on the stock (BZFD), as well as the warrants (BZFDW), and in full disclosure, we own both as well as some call options…In the first article, I discussed the improving fundamentals and how drastic the recent changes have been…It’s posted HERE…The second in the series discussed the technicals and looked at the charts which you can find HERE…

“The Street was pessimistic and that, of course, is how bottoms are made in stocks and in markets… I have always been much more interested in picking a turn, an inflection point, than in playing an already existing trend.”

~ Michael Steinhardt (fund manager who achieved returns >30%/YR)

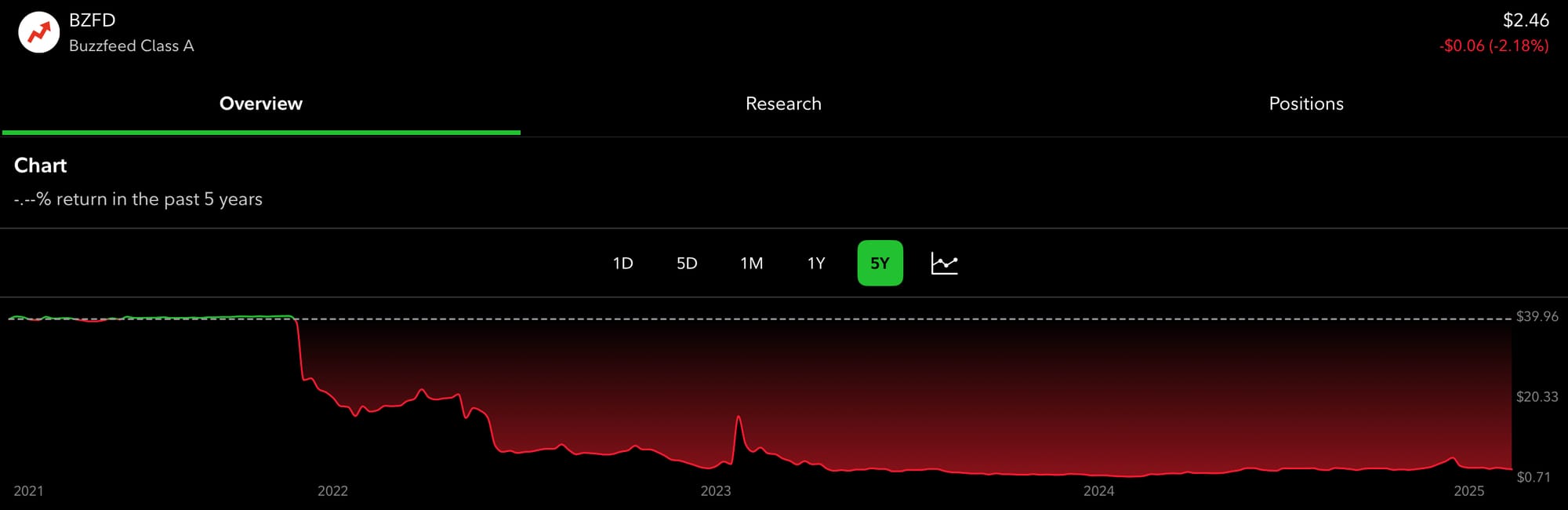

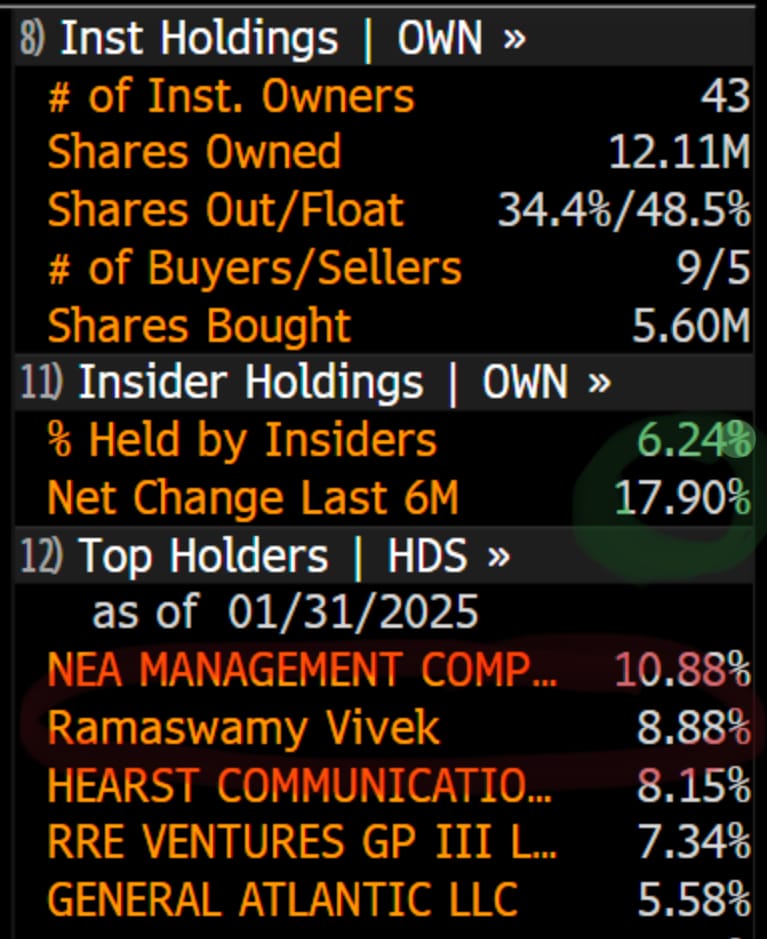

To say the least, BuzzFeed shareholders and fans lost their shirts (or perhaps blouses 🤔🤨)…The stock dived as is clear from the chart above…But sometimes an asset gets to be so cheap that value investors (known less kindly as “vulture investors”) start to circle…They are hunting for hidden value. But we’re not just talking about retail / Mom&Pop investors—the smart money is getting involved in a big way…Case in point, Vivek Ramaswami…Please see below, not only who owns the stock, but how much they’ve been buying in the interim.

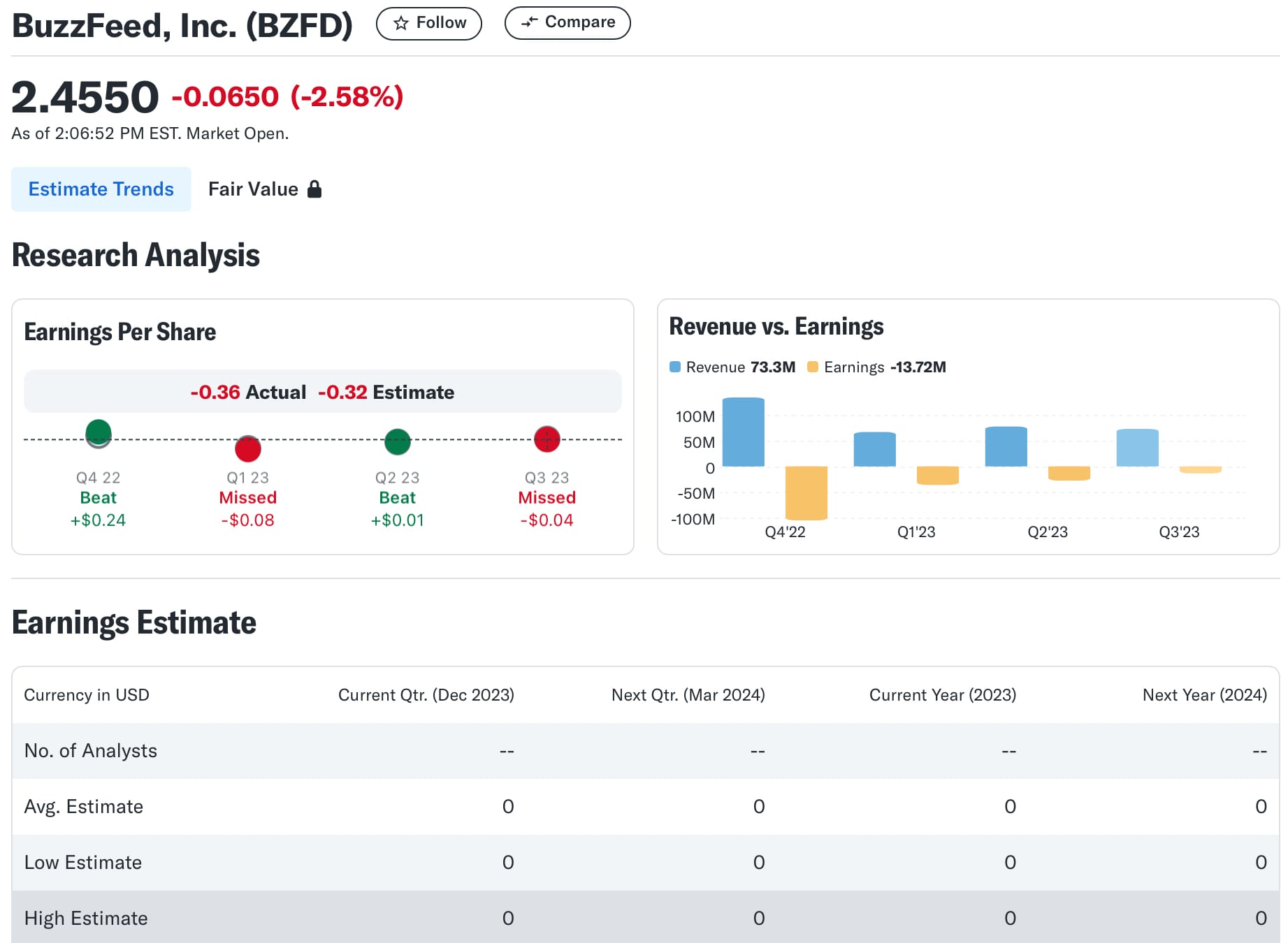

Insiders are busy buying and even the institutions (which own almost half of the float) are buying more than selling…They seem to see the turnaround in progress as we do. But the most interesting insider is Vivek Ramaswamy. He has proven his capabilities in making money as well as communicating his ideas…Vivek is persuasive AF and I think he will be a great activist to have a fellow shareholder. After all, he literally wrote the book against wokeism—arguably a big reason for BuzzFeed’s demise. Sounds like a fascinating story, so why doesn’t Wall Street give a 💩?! Why isn’t anyone covering the stock? Please find below the “analysts’ estimates”…As you can see, few firms are following the company.

But wait, let’s see what’s up on Seeking Alpha…Same story—but with one important caveat—Wall Street may not care—but REAL analysts (read: investors that do their own homework) seem to LOVE it!

So, even though the opportunity is huge, the float (number of shares traded publicly) is tiny—I think there’s less than 16 million (this is UNHEARD OF for a company like this). And with such a small share count trading in public, it doesn’t take much demand to catapult shares into a rapid rally.

More structural reasons to be bullish include:

- With activists on the board, expect more strategy and less spending (especially on the broke-ass woke agenda).

- If you combine the things WE KNOW FOR SURE 👇🏼

A). The fourth quarter of the year seems to consistently be BuzzFeed’s strongest.

B). 4Q24 was unique in the sense that the political ad spend will likely break records

C). The continue to sell off assets, pay off debt, and increase their focus on high margin projects

D). The fact that volume charts seem to show the weak hands have folded and remaining shareholders have a longterm & strategic view.

So in my not so humble opinion, the math speaks for itself:

Few Shares Available + Smart Money Busy Buying - Weak Shareholders = Potential for a Multi-Bagger! 🤑

NOT INVESTMENT ADVICE…NOT INVESTMENT ADVICE…INVESTING = RISK